Is Your Business Ready to Navigate the EMIR Refit Changes?

With the impending changes brought about by the EMIR Refit, it’s essential for businesses to assess their readiness and take proactive steps to ensure compliance. The European Market Infrastructure Regulation (EMIR) Refit introduces significant modifications that can impact various aspects of your operations. To safeguard your business and successfully navigate this regulatory evolution, consider the following:

- Impact Assessment: Begin by gaining a deep understanding of the EMIR Refit’s key provisions and how they pertain to your business. This involves identifying the specific business functions where adjustments are necessary. Identifying key changes in the regulation and assessing impact in terms of applicability and traceability of the changed regulatory articles and fields.

- Engage Stakeholders: Collaborate with relevant stakeholders across your organization, including legal, compliance, risk management, operations, and IT teams. Ensure everyone comprehends the implications of EMIR Refit and their respective roles in implementation.

- Gap Analysis: Evaluate your current processes, systems, and workflows that relate to derivative transactions, reporting, and risk management. Pinpoint potential gaps or areas that require alignment with the new requirements. Identify data sources for new fields (e.g. UPI), update requirements for changed fields (e.g. UTI) and identify gaps where data is not available internally.

- System Readiness: Assess the readiness of your technological infrastructure. Determine whether your systems can accommodate the changes required for reporting, data collection, and other relevant functions. Remember TRs will accept trade reports and provide responses in XMLs only and this is not a small change!

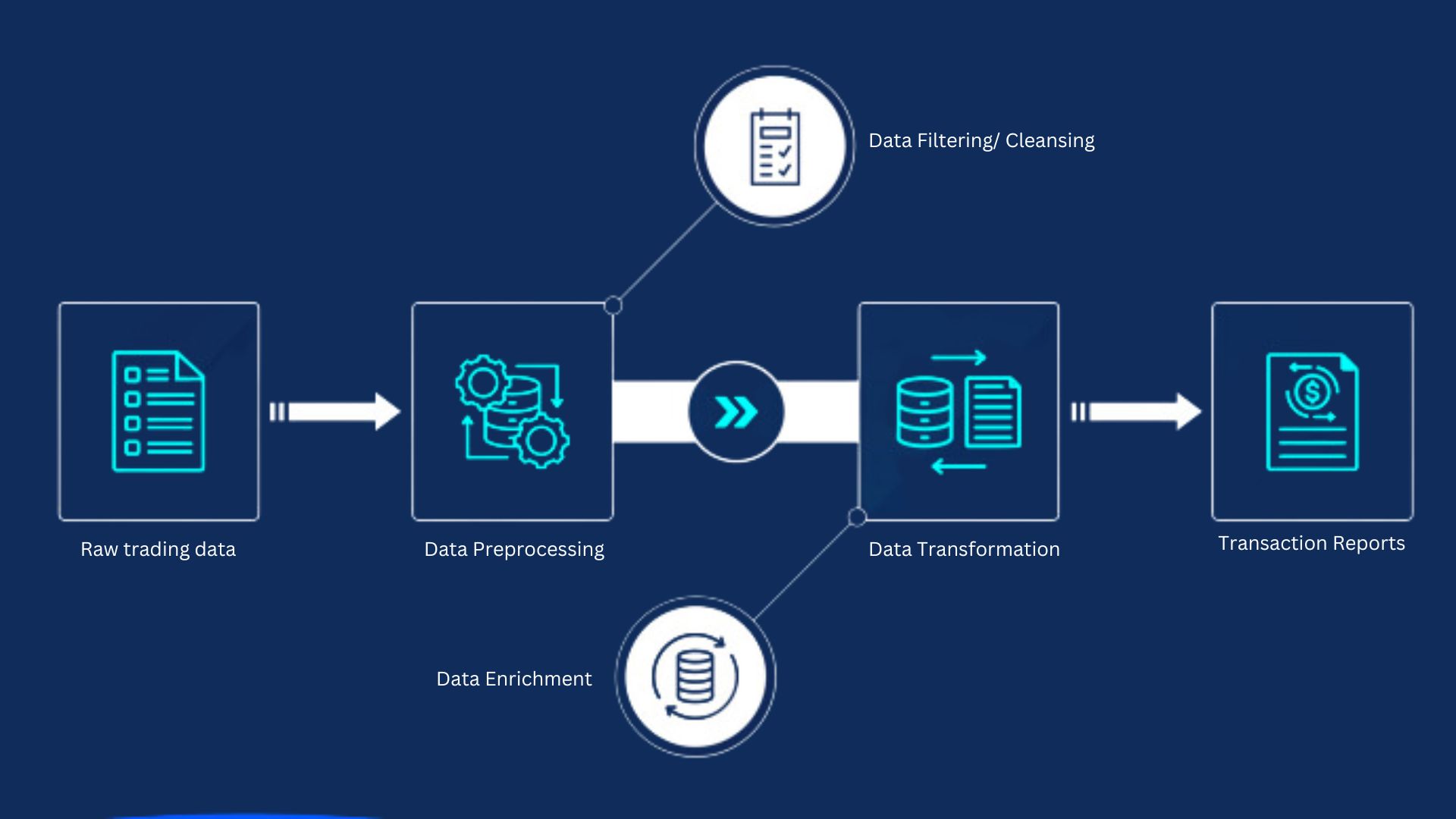

- Data Management: EMIR Refit may demand alterations in the way you collect, store, and manage data (e.g. counterparty information). Ensure that your data management practices align with the new reporting and transparency requirements.

- Process Alignment: Review your trade and transaction reporting processes to ensure they comply with EMIR Refit’s specifications. This might involve adjusting your reporting timeline, data elements, and other relevant factors. For delegated reporting, you will need to have a very robust reconciliation process. This is especially important now that NCAs are going to have a very strict threshold on reconciliation breaks.

- Testing and Validation: Rigorously test the updated systems and processes to identify and rectify any potential issues or errors. Thorough testing helps in minimizing disruptions during the transition. Remember to test back loading as that is where major mistakes are made!

- Documentation and Training: Update your internal documentation, manuals, and guidelines to reflect the changes introduced by EMIR Refit. Provide comprehensive training to your employees, enabling them to effectively implement the new processes.

- Engagement with Regulators: Stay informed about the guidance provided by regulatory authorities regarding EMIR Refit. Engage in dialogue with regulators to clarify any uncertainties and seek additional guidance if needed. There will be some changes via Q&As later in the year.

- Contingency Planning: Develop contingency plans to address unforeseen challenges that might arise during the implementation phase. Having a backup strategy can help mitigate disruptions to your operations.

- Timely Action: Most importantly “Begin your EMIR Refit implementation sooner rather than later.” Avoid the pitfalls of procrastination by starting now to allow ample time for adjustments, testing, and addressing any unforeseen hurdles.

By approaching EMIR Refit with a proactive mindset, your business can position itself to not only meet regulatory requirements but also adapt smoothly to the changing landscape. Being prepared ensures that you can continue to operate efficiently, minimizing potential risks and maximizing the opportunities presented by the evolving regulatory framework.