Another success story in MiFID II Back Reporting

We are observing a trend in the market of firms developing in-house back reporting platforms. Bespoke in house developed platform may not be the most effective solution for the back reporting problem. We believe our always-on automated secure software-as-a-service back reporting platform can solve this problem in a much more efficient and faster way.

Here is a case study where we helped one of our clients achieve a significant economy of scale and efficiency. Combining our expertise, skills and experience in regulatory reporting we helped our client save significantly in terms of costs and efforts and helped achieve compliance much faster as compared to what they could have achieved in-house

Key challenges client faced in back reporting of MiFID II transactions:

- Tens of thousands of historical transactions were reported incorrectly

- Errors in transactions were since 3rd Jan 2018

- Extracting data from trading platforms was challenging due to vendor limitations

- In some incorrect transactions, there were more than one error

- Errors were not only at field levels but were at the transaction levels like some transactions were over reported

- Reference data like LEI, clients data were incorrect

- Client had engaged a accuracy platform but platform just identified errors and did not help in back reporting or remediation

- Under reported transactions had to be reconstructed for reporting

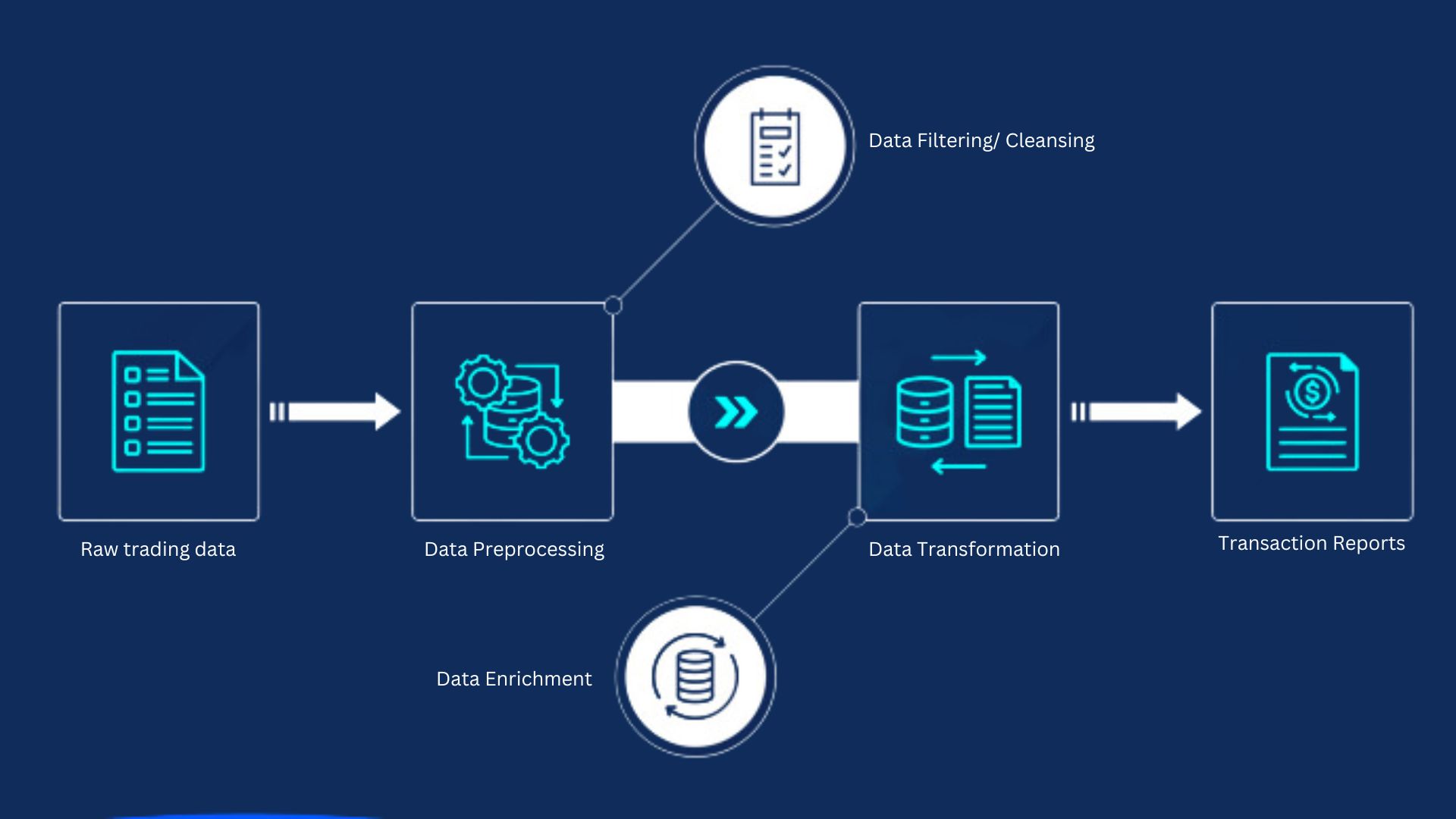

Our approach to solve this problem:

- We have set up a team to address these challenges client had

- We have analyzed client errors and categorized them into two categories:

Category 1 – generic errors due to instrument type, eligibility etc.

Category 2 – client specific errors

- Our back reporting platform addressed generic errors out of box making back reporting process much more efficient

- Dedicated team then automated client specific errors

- Platform them processed the data from 3rd Jan 2018 and produced back reporting files containing remediated transactions only

- Back reporting files were reviewed by Reg ops and compliance and were signed off for back reporting

- Back reporting files were then submitted to ARM and within a very short span of time client become fully compliant

Client appreciated the immense value Reg-X delivered and retained us for some further data quality work. If you are interested to know more, please get in touch on [email protected] or 020 8145 5473.

Additional Services:

You can outsource your Regulatory operations, Regulatory Change Management and Regulatory testing functions to us. We cover major global regulations including MiFIDII (Transaction Reporting – MiFIR, Trade Reporting, Record Keeping), EMIR, SFTR, CSDR, MAS, MAR, ASIC, CFTC and other regulations. Our products and services are Cost effective and value driven. Our aim is to provide you best compliance in a most cost-effective way