CBI Fines Global Reach, Highlighting Key Lessons for EMIR Compliance

The Central Bank of Ireland (CBI) has reprimanded and fined an investment fund for failing to report derivatives trades to a trade repository in breach of its reporting obligation under the European Markets Infrastructure Regulation (EMIR). The fine was imposed on November 30, 2023, and is the first time the CBI has fined an investment …

Read more "CBI Fines Global Reach, Highlighting Key Lessons for EMIR Compliance"

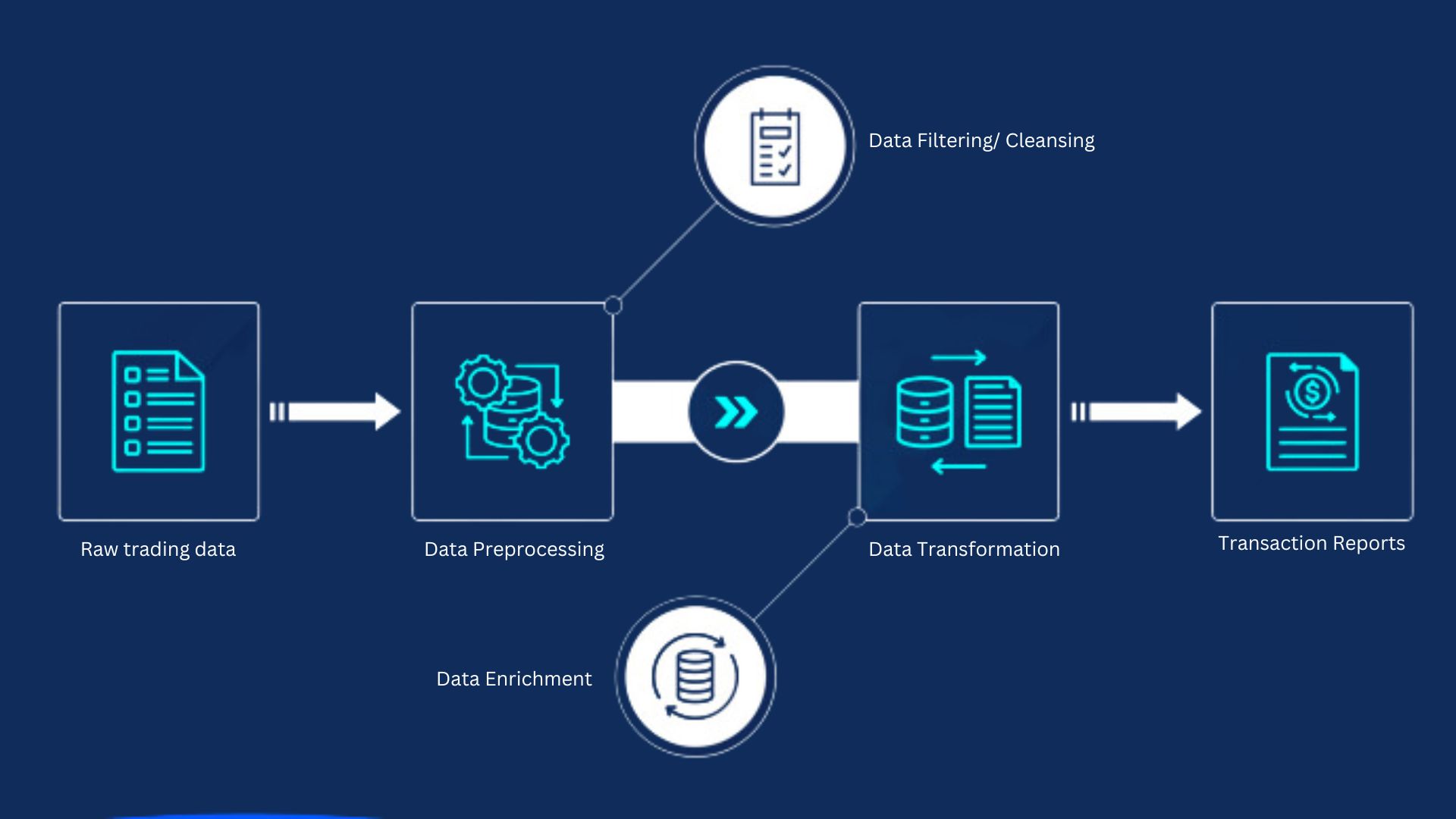

EMIR Refit Reporting Software

Streamlining Derivatives Reporting EMIR Refit, the European Market Infrastructure Regulation Regulatory fitness update, has brought about substantial alterations to the regulatory landscape governing derivatives trading within the European Union. These changes aim to enhance EMIR’s efficiency but introduce unique challenges for market participants and regulatory bodies. To successfully overcome these challenges, a comprehensive approach is …

Navigating Regulatory Challenges: FCA’s Market Watch

The financial landscape’s regulatory terrain remains intricate and ever-evolving. The Financial Conduct Authority (FCA) continues its vigilance against common transaction reporting errors through its latest newsletter, Market Watch 74. This edition stands out not only for addressing known issues but also for shedding light on previously unexplored concerns, offering a comprehensive guide to compliance. Market …

Read more "Navigating Regulatory Challenges: FCA’s Market Watch"

Is Your Business Ready to Navigate the EMIR Refit Changes?

With the impending changes brought about by the EMIR Refit, it’s essential for businesses to assess their readiness and take proactive steps to ensure compliance. The European Market Infrastructure Regulation (EMIR) Refit introduces significant modifications that can impact various aspects of your operations. To safeguard your business and successfully navigate this regulatory evolution, consider the …

Read more "Is Your Business Ready to Navigate the EMIR Refit Changes?"

FCA MarketWatch 74 and Supervisory flexibility on transaction reporting

FCA released the MarketWatch 74 newsletter on market conduct and transaction reporting issues on 25th July. Subsequently FCA released a statement “Supervisory flexibility on transaction reporting” which included updates on a few fields which are going to create a possible divergence with the EU in future. We will only focus on RTS22 updates from Market …

Read more "FCA MarketWatch 74 and Supervisory flexibility on transaction reporting"

EMIR Refit is expanding scope of derivatives reporting and now includes Crypto derivatives reporting.

ESMA has provided guidelines on reporting of derivatives on crypto-assets as part of EMIR Refit guidelines so it is now clear that crypto derivatives are required to be reported removing any ambiguity. A new field is introduced by the regulator to identify such derivatives. Scope of reporting is expanded to only those derivatives on crypto-assets …

Getting ready for EMIR REFIT (UPI) – Unique Product Identifier (UPI)

Emir Refit UPI – In this blog we take a look at the newly introduced field UPI. ANNA DSB defines UPI as “UPI stands for ‘Unique Product Identifier’ and is designed to facilitate effective aggregation of over-the-counter (OTC) derivatives transaction reports on a global basis”. A Unique Product Identifier (UPI) is a unique code that …

Read more "Getting ready for EMIR REFIT (UPI) – Unique Product Identifier (UPI)"

UTI reporting changes in EMIR REFIT

Emir Refit – UTI stands for Unique Trade Identifier, which is a unique identifier assigned to a trade in order to report trade data to trade repositories. The UTI is a critical component of the trade reporting process under EMIR REFIT, as it helps ensure the accuracy and integrity of the trade data that is …

EMIR Refit reporting starts in April and September 2024 – what it means for companies

The European Market Infrastructure Regulation (EMIR) Refit go-live dates have been annou nced for the EU and the UK. EMIR trade reporting obliges all companies engaged in over-the-counter (OTC) and exchange-traded (ETD) derivatives trading to report the trades and valuations to a repository. The regulation applies in the European Union (EU-EMIR) and the United Kingdom …

Read more "EMIR Refit reporting starts in April and September 2024 – what it means for companies"

Another success story in MiFID II Back Reporting

We are observing a trend in the market of firms developing in-house back reporting platforms. Bespoke in house developed platform may not be the most effective solution for the back reporting problem. We believe our always-on automated secure software-as-a-service back reporting platform can solve this problem in a much more efficient and faster way. Here …

Read more "Another success story in MiFID II Back Reporting"